Building business credit is a crucial step for any entrepreneur looking to grow their business. It not only helps in securing better terms on loans and lines of credit but also establishes the company’s financial credibility. Here’s a step-by-step guide to building your business credit, featuring insights on leveraging tools like myFICO, DisputeBee, and Credit Repair Cloud.

Also Read: How to Waive Annual Fees on Credit Cards: A Strategic Guide

1. Understand Business Credit

Business credit, similar to personal credit, is a measure of your company’s financial responsibility, but it’s tied specifically to your business’s operations. It’s crucial for securing financing under favorable terms. Understanding business credit involves knowing how credit bureaus, such as Dun & Bradstreet, Equifax Business, and Experian Business, score your business activities.

These scores are used by lenders, suppliers, and other entities to evaluate your business’s creditworthiness. Building a strong business credit profile means your business is seen as less risky, potentially leading to lower interest rates on loans, higher lines of credit, and more favorable payment terms from suppliers.

2. Establish Your Business Entity

Establishing your business as a separate legal entity, such as an LLC or corporation, is the first critical step in building business credit. This separation legally distinguishes your personal finances from your business’s finances. It’s not just about legal protection; it’s about setting the foundation for your business credit.

By incorporating, you ensure that your business activities are reported under the business’s name and EIN, not your personal social security number. This step is fundamental for businesses aiming to build a credit history separate from the personal credit of their owners.

3. Obtain an EIN

An Employer Identification Number (EIN) is essentially your business’s social security number and is vital for several reasons. It’s required for filing taxes, hiring employees, and, most importantly for this context, establishing business credit.

Applying for an EIN is a free service offered by the IRS. With an EIN, you can open a business bank account, apply for business licenses, and start building your business credit profile. Think of your EIN as your business’s entry ticket into the world of credit and finance.

Also Read: Best Credit Repair Business Software Kit to Kickstart Like a Pro

4. Open a Business Bank Account

A business bank account is where your business financial transactions should be conducted. It serves as a clear indicator of your business’s cash flow and financial health to potential creditors. Having a business bank account helps in establishing your business’s financial history, which is crucial when applying for business credit.

This account is also essential for managing your company’s finances effectively, keeping personal and business expenses separate, which is a basic principle of good business financial management.

Also Read: Can I Open a Bank Account with a Bad Credit?

5. Establish Credit with Vendors and Suppliers

One practical method to begin building business credit is by establishing lines of credit with vendors and suppliers that report to the major business credit bureaus. This step can kickstart your business’s credit history, even if your business is relatively new. Paying these invoices on time, or even early, can positively impact your business credit score.

It’s a way to prove your business’s financial reliability without needing to secure large loans or lines of credit from banks.

6. Use Business Credit Cards Wisely

Business credit cards are not just tools for managing business expenses; they’re instrumental in building your business credit. When used responsibly, they can help you establish a credit history for your business. It’s vital to choose cards that report to the business credit bureaus and to ensure that you make payments on time.

Over time, responsible use of business credit cards will contribute positively to your business credit score, enhancing your creditworthiness.

7. Monitor Your Business Credit

Monitoring your business credit is essential for understanding how your business is viewed by lenders, suppliers, and other financial entities. Regular monitoring allows you to track your progress in building credit, identify any issues or inaccuracies, and take corrective action when necessary.

This is where myFICO comes into play, offering comprehensive credit monitoring services that give you insights into your business’s credit standing across the major credit bureaus. Read our detailed review on myFICO for a more clear picture.

FICO is also a standard credit score that is widely used by financial institutions like banks. There are various types of FICO scores, with each type based on need. You can get these scores on myFICO.

Here are what the FICO scores mean in general,

| FICO Score | Meaning |

|---|---|

| 800-850 | Exceptional |

| 740-799 | Very Good |

| 670-739 | Good |

| 580-669 | Fair |

| 300-579 | Very Poor |

8. Leverage Credit Repair Tools

DisputeBee and Credit Repair Cloud are invaluable resources for addressing inaccuracies on your credit reports that could be negatively impacting your scores. Both platforms offer robust features for disputing errors with credit bureaus, from generating dispute letters to managing client accounts for those operating credit repair businesses.

Correcting these errors can significantly improve your business credit score, making your business more attractive to lenders and creditors.

Choosing between DisputeBee and Credit Repair Cloud depends on your specific needs, with DisputeBee being particularly user-friendly and Credit Repair Cloud offering a comprehensive suite for more extensive credit repair operations.

If you are confused between DisputeBee and Credit Repair Cloud, you can read our comprehensive comparison: DisputeBee vs Credit Repair Cloud.

FAQs on Building Business Credit

Building business credit is a process that can take several months to a year, depending on your financial activities and how they are reported to credit bureaus.

Yes, you can build business credit independently of your personal credit. However, some lenders may consider your personal credit during the early stages of your business.

Not all vendors report to credit bureaus, so it’s important to establish credit terms with those who do to ensure your payments are helping to build your credit history.

While not necessary, credit repair software like DisputeBee and Credit Repair Cloud can be extremely helpful in managing and disputing inaccuracies on your credit reports, thereby potentially boosting your credit scores.

Wrapping Up: How to Start Building Business Credit

Building business credit is a critical step for any company’s growth and financial health. By following these steps and utilizing tools like myFICO, DisputeBee, and Credit Repair Cloud, you can establish a solid credit foundation for your business.

Remember, a strong business credit score not only helps in securing financing but also builds your company’s reputation in the financial community.

The Credit Saint

Ranked #1 in tackling inaccurate credit entries, Credit Saint is appreciated by almost every other consumer company. It has better plans and a simple process. The best part? You get a 90-day money-back guarantee.

There are pricing models designed as per the need of consumers and well suit their interests. This credit repair company also back #1 position in BBB credit rating and consumer affairs.

| In Business Since | Overall Rating | Reputation Score |

|---|---|---|

| 2004 | 4.7/5 | 9/10 |

The Credit People

Credit People has helped thousands of people fix their credit reports. By far, it is one of the cheapest and least expensive services, with better results and dedicated professionals.

The perks of using The Credit People include free credit scores and credit reports when you opt for their services. These affordable credit restoration services can boost your credit score with an average of 53-187 credit points.

| In Business Since | Overall Score | Reputation |

|---|---|---|

| 1999 | 4.5/5 | 9.0/10 |

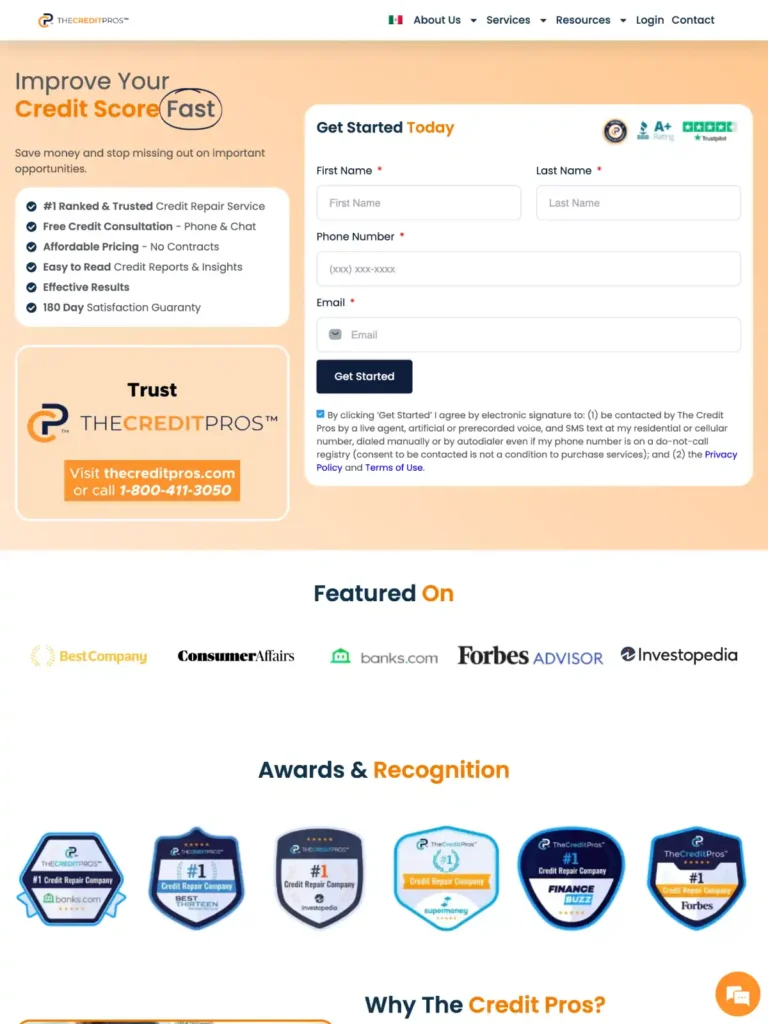

The Credit Pros

TheCreditPros.com offers a comprehensive range of credit repair services designed to help improve your credit score quickly and efficiently. They provide personalized dispute letters, credit monitoring, and identity theft protection.

With a team of experienced professionals, TheCreditPros.com ensures compliance with legal standards, and its user-friendly platform makes it easy to track your progress. Their customer-centric approach and transparent pricing have earned them high ratings and positive reviews from satisfied clients.

| In Business Since | Overall Score | Reputation Score |

|---|---|---|

| 2009 | 4.7 | 8/10 |

Credit Firm

Serving in key financial areas ever since 1997, The Credit Firm has proven to be one of the best. With the support of professional attorneys, credit repair experts, financial guides, and dozens of other core members on the team, it has proven to be actionable in and around 50 states of America.

“Credit Firm” has a straightforward process for fixing credit scores, making them one of the best. This service is best for those who are looking for better jobs and faster credit and loan approvals.

| In Business Since | Overall Rating | Reputation Score |

|---|---|---|

| 2010 | 4.0 | 7/10 |