If you have a bad credit score, you must be knowing how hard it is to balance and maintain good credit scores. But one way to fix your bad credit score and improve the scores is to clear negative entries from your credit report. To remove the negative entries or credit errors, you need to write a 609 dispute letter to the creditor(s) and bureaus and ask them to remove the credit error from your credit report. But how do you write a dispute letter to creditors or bureaus? Let me give you the details in the following guide.

Generate automated dispute letters to credit bureaus, creditors, collectors, and more using DisputeBee; You can read our DisputeBee Review before trying it out.

What is a Dispute Letter?

A dispute letter is a letter that you send to the creditors, bureaus, collectors, and other credit departments to get the negative entries removed from your credit report. The negative entries are defined as inaccurate information on your credit report, such as transactions you never made. These entries may look standard and normal, but these are the ones that decrease your credit score.

In your credit dispute letter, you can mention why you find the entry negative and attach supporting documents to make the dispute process faster and boost your credit score.

Here are a few things you can dispute on your Credit Dispute Letter –

When your dispute is found right, the negative information is removed, and your credit score is boosted. However, there is no guarantee that the negative entry will be removed by the creditors or the bureaus. In such a condition, you can also take the help of an attorney or legal and get the dispute removed. But be sure to have enough supporting documents.

Also read: How to Write a 609 Dispute Letter [With Samples/Template]

Dispute letters are not easy; writing a poor one without confidence can reduce your chances of getting negative information from your credit report. Use DisputeBee to generate and track automated dispute letters.

What to Write in a Dispute Letter to a Creditor?

When writing a dispute letter to a creditor, there are few things you need to take care of. The first question you have on your mind is what to mention and the format or if there are any samples for dispute letters for creditors.

Don’t worry; we covered it all. You can still use DisputeBee to make ready-made dispute letters and cut the extra time in writing one.

Here is the format of dispute letters to creditors,

- Affective date

- Name of the Company / Creditor

- Address of the creditor

- Personal information (Name, Account Number, Address)

- Opening salutation

- Subject

- Description of Error in brief (better if listed)

- Any reasonable and valid points that support your statement.

- Supporting documents attached

- Asking creditors to remove the negative entries as per fair debt collection practice.

- Closing salutation

Manually writing dispute letters needs some great attention; you don’t want to sound wrong, rude, or inappropriate. Instead, use DisputeBee to write an automated pitch-perfect letter to get your negative entries removed. You can read the DisputeBee Review before heading to it.

You may also like to read,

- Best Credit Repair Business Software Kit to Kickstart Like a Pro

- DisputeBee vs Credit Repair Cloud | Which is the Best Credit Repair Software

- Best White Label Credit Repair Software – Credit Repair Cloud

Hire a Credit Repair Agency

A credit repair agency can help you reduce the cost involved, and they are also professionals. There are several reasons why we would suggest a credit repair company and not just any other credit repair company. Many companies claim to get the work done but fail miserably, which is why we handpicked a few of the best ones.

The Credit Saint

Ranked #1 in tackling inaccurate credit entries, Credit Saint is appreciated by almost every other consumer company. It has better plans and a simple process. The best part? You get a 90-day money-back guarantee.

There are pricing models designed as per the need of consumers and well suit their interests. This credit repair company also back #1 position in BBB credit rating and consumer affairs.

| In Business Since | Overall Rating | Reputation Score |

|---|---|---|

| 2004 | 4.7/5 | 9/10 |

The Credit People

Credit People has helped thousands of people fix their credit reports. By far, it is one of the cheapest and least expensive services, with better results and dedicated professionals.

The perks of using The Credit People include free credit scores and credit reports when you opt for their services. These affordable credit restoration services can boost your credit score with an average of 53-187 credit points.

| In Business Since | Overall Score | Reputation |

|---|---|---|

| 1999 | 4.5/5 | 9.0/10 |

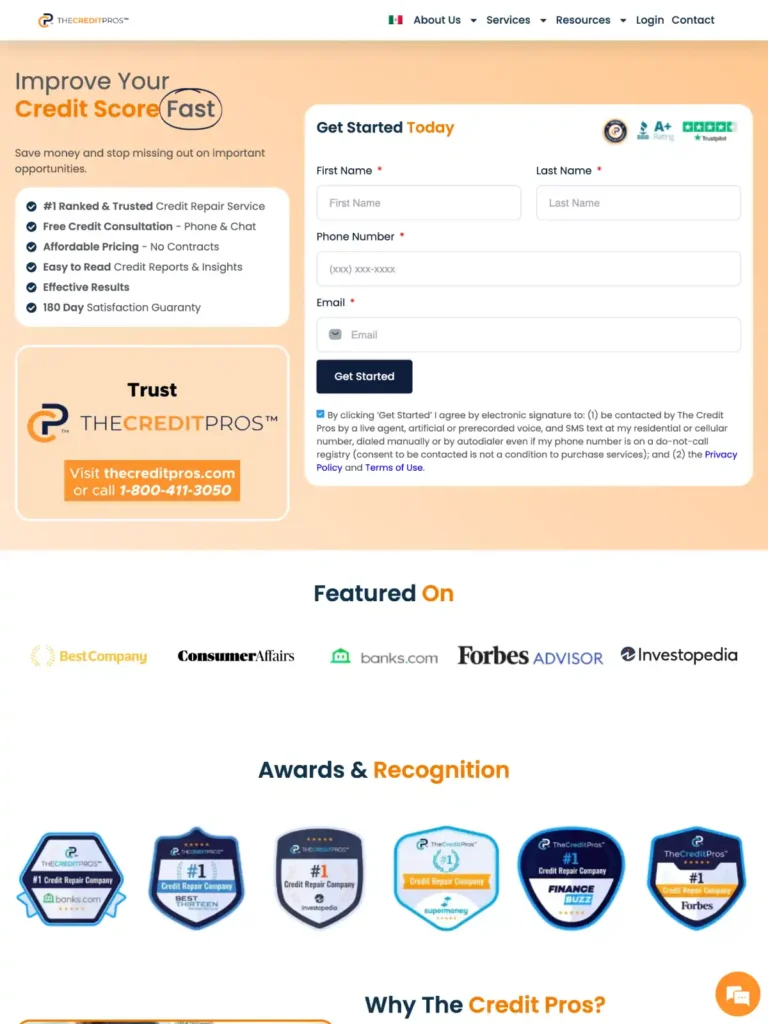

The Credit Pros

TheCreditPros.com offers a comprehensive range of credit repair services designed to help improve your credit score quickly and efficiently. They provide personalized dispute letters, credit monitoring, and identity theft protection.

With a team of experienced professionals, TheCreditPros.com ensures compliance with legal standards, and its user-friendly platform makes it easy to track your progress. Their customer-centric approach and transparent pricing have earned them high ratings and positive reviews from satisfied clients.

| In Business Since | Overall Score | Reputation Score |

|---|---|---|

| 2009 | 4.7 | 8/10 |

Credit Firm

Serving in key financial areas ever since 1997, The Credit Firm has proven to be one of the best. With the support of professional attorneys, credit repair experts, financial guides, and dozens of other core members on the team, it has proven to be actionable in and around 50 states of America.

“Credit Firm” has a straightforward process for fixing credit scores, making them one of the best. This service is best for those who are looking for better jobs and faster credit and loan approvals.

| In Business Since | Overall Rating | Reputation Score |

|---|---|---|

| 2010 | 4.0 | 7/10 |

Wrapping up: How to Write a Dispute Letter to Creditor

Writing a dispute letter to a creditor is not complicated but requires some attention. Always attach supporting documents such as bills or legal papers that prove the credit errors and get them removed. If you do not attach supporting documents, the creditors will stick to the entry to be negative and then do nothing about it. So, write a professional and confident letter (Best with DisputeBee) and attach documents and proof to get your negative information removed faster.