If you want to improve your credit scores, start a credit repair business, or even just want to know your credit situation, credit scores it is. Most Businesses, creditors, collection agencies, and even real estate look for these scores, and they decide if you get more credit and how much in numbers. But there is not a single credit score scheme that most creditors or such agencies follow – a few options are Credit Karma, Credit Score, and the popular myFICO scores.

But how do you get these scores?

One of the best platforms I encountered is myFICO, the official consumer division of FICO SCORE and FICO. In this article, I thoroughly use my experience and review myFICO credit score monitoring and how you can get the most information about your current credit situation with this tool.

myFICO Credit Score Monitoring Overview

Overall Rating:

If you are looking for a credit score monitoring tool for your personal or professional purpose, myFICO is the perfect choice for you. It is the official consumer division of FICO scores that most creditors, banks, and collection agencies use to assess your credit situation. With this tool, you can get credit scores and reports from all three bureaus, but please note that not all transactions and credit report data are monitored.

There are more than 30 types of FICO Scores, but with myFICO, you are specifically looking for FICO Score 8 and a few other additional FICO scores. Moreover, FICO Score 8 score changes are triggered once daily, so you can have updated scores each time you want to know your credit situation.

Overall, myFICO does most of your credit score monitoring tasks, and in the detailed review below, you can find how easy it is to set it up. There are a few downsides, such as not all credit entries or transactions are monitored; however, with features such as monthly score updates, and goal-specific scores, myFICO is just the perfect addition to your credit repair software business kit.

Pros

Cons

What are FICO Scores?

FICO (Fair Isaac Corp) is a credit model like Vantage Score or Credit Scores that helps you monitor your credit situation with 30+ kinds of FICO Scores. It is a three-digit score ranging from 300 to 850 points, and the higher the points, the easier it is to get loans or credit.

But why 30+ different kinds of FICO scores? FICO has been there since the late 80s, and throughout these years, FICO has devised different kinds of loans for different purposes. Lenders, creditors, businesses, estates, and all other loan providers can use different FICO Scores that suit their kind of loan.

However, the most commonly used FICO Scores are FICO Score 8 and FICO Score 9 for credit assessments. However, with a FICO Score of 10, you can know your credit risk. Each FICO Score gives different kinds of scores for different loan purposes.

With myFICO, you get monthly updates on changes and triggers in these scores directly on your smartphone. Alongside this, you also get access to other kinds of FICO Scores using the same tool.

The FICO Scores are divided into multiple ranges from 300 to 850 points, and this range is used to analyze your credit situation. If your FICO score range is near 800 points, your credit situation is exceptional, and it is easier for you to obtain new loans. With such outstanding scores, creditors are assured that you are likely to repay their loan in a timely manner, ensuring their money is safe.

Here is a much more detailed range of FICO Scores with their meanings,

| FICO Score | Meaning |

|---|---|

| 800-850 | Exceptional |

| 740-799 | Very Good |

| 670-739 | Good |

| 580-669 | Fair |

| 300-579 | Very Poor |

myFICO is the best tool to monitor your FICO Scores on the go and get updates immediately on your Android or iOS smartphone. You get FICO Scores such as FICO Score 8 and FICO Score 9, along with several other FICO Scores. With myFICO, you also get features like identity theft insurance, monitoring, and more.

*It does not include identity theft insurance and comes with limited features.

Also read: FICO Score vs Credit Score: Which is the Best Credit Monitoring Tool?

What is myFICO? FICO Scores Monitoring Tool

With a mission to improve my credit scores, I first wanted to access these credit scores and that too from all three bureaus. After trying a bunch of options, I finally came across my FICO, which suits my credit score needs well.

myFICO is a consumer division of FICO Scores and FICO and helps users directly get access to their scores with the least effort. You can either access these myFICO scores from your dashboard or use the app to get them at your fingertips.

While myFICO is an app, it is not just a credit score monitor – you can do a bunch of things with this app. With myFICO, you can easily monitor selective transactions and credit report data, get scores for mortgages, auto loans, and more, monitor your identity information, restore your identity 24X7, and even get identity theft insurance for up to $1 million.

So, you can mainly understand myFICO into two parts – Credit monitoring and identity theft. However, identity theft with myFICO is managed by third-party American Bankers Insurance Company with their own policies, terms, and conditions.

Let’s discuss myFICO in much more detail.

myFICO Features

In my opinion, there are a lot of times when users spend their valuable money on tools that hardly have anything to offer. Besides, given the credit situation, it is also important that any liquid you spend does not end up in the trash or add up to your debts.

myFICO is a trustworthy and reliable credit score monitoring service, but is it the best one to help you out? Let’s look at what features myFICO has to offer.

1. FICO Scores – Monitor your Credit Scores with a Three-Digit Number

The major feature of using myFICO is to know your credit situation through your credit scores. Since myFICO is a direct consumer division of FICO Scores, you can rely on it to get timely credit score updates on FICO Score 8, FICO Score 9, and almost 30 other kinds of FICO scores.

FICO Scores are three-digit numbers in the range from 350 to 850 points with different meanings. If your score is near 800 points, you have an exceptional score, and you can easily avail of loans from almost all creditors, businesses, loan sharks, and more. However, there is a twist, not all FICO Scores are the same, and based on the type of loan, you need to select the kind of FICO Score. With myFICO, you can do it with ease and also get quick updates to score on your smartphone.

The Basic plan gives you FICO Scores from a single credit bureau (Experian), while you can get FICO Scores from all three bureaus using the Advanced and Premier plan. Besides, you get a timely updated score each month with the highest and the most basic plan.

2. Scores for Mortgages, Auto Loans, and More

Unlike credit scores, myFICO does not have a single score on your credit profile; instead, FICO generates different kinds of scores for types of credits. So, if you wish to get credit for Auto, creditors can use Auto-specific FICO Scores from your credit profile, such as FICO® Auto Score 2, FICO® Auto Score 5, and FICO® Auto Score 4 from all three bureaus. Likewise, for mortgage, credit card decisions, auto, and other kinds of loans, creditors can request that specific FICO score.

Here are the different kinds of FICO Scores that you can get by using myFICO –

Widely used FICO Scores

| Experian | Equifax | TransUnion |

|---|---|---|

| FICO® Score 9 | FICO® Score 9 | FICO® Score 9 |

| FICO® Score 8 | FICO® Score 8 | FICO® Score 8 |

FICO Scores used in Auto Lending

| Experian | Equifax | TransUnion |

|---|---|---|

| FICO® Auto Score 9 | FICO® Auto Score 9 | FICO® Auto Score 9 |

| FICO® Auto Score 8 | FICO® Auto Score 8 | FICO® Auto Score 8 |

| FICO® Auto Score 2 | FICO® Auto Score 5 | FICO® Auto Score 4 |

FICO Scores used in Credit Card Decisioning

| Experian | Equifax | TransUnion |

|---|---|---|

| FICO® Bankcard Score 9 | FICO® Bankcard Score 9 | FICO® Bankcard Score 9 |

| FICO® Bankcard Score 8 | FICO® Bankcard Score 8 | FICO® Bankcard Score 8 |

| FICO® Score 3 | FICO® Bankcard Score 5 | FICO® Bankcard Score 4 |

| FICO® Bankcard Score 2 | – | – |

FICO Scores in Mortgage

| Experian | Equifax | TransUnion |

|---|---|---|

| FICO® Score 2 | FICO® Score 5 | FICO® Score 4 |

Newly Released FICO Scores

| Experian | Equifax | TransUnion |

|---|---|---|

| FICO® Score 10 | FICO® Score 10 | FICO® Score 10 |

| FICO® Auto Score 10 | FICO® Auto Score 10 | FICO® Auto Score 10 |

| FICO® Bankcard Score 10 | FICO® Bankcard Score 10 | FICO® Bankcard Score 10 |

| FICO® Score 10T | FICO® Score 10T | FICO® Score 10T |

3. Credit Reports, Scores, and Monitoring

With myFICO, monitoring your credit reports and scores becomes much easier. Since you can have the myFICO app on your phone, you can instantly view your score and report changes on your phone itself. The tool generates quick alerts when there is a change or trigger on your credit report or score.

Besides, you can monitor selective negative entries on your credit reports that you already have in your disputes. So, keeping an update on your credit score becomes much easier.

A few helpful articles for disputing negative credit items,

- DisputeBee Review

- DisputeBee vs Credit Repair Cloud | Which is the Best Credit Repair Software

- How to Write a Dispute Letter to a Creditor

- Dispute Letter Template [Sample Included]

- How to Write a 609 Dispute Letter [With Samples/Template]

In my opinion, myFICO is perfect for tracking your FICO Scores and the changes in them. Unlikely, other apps and services do not give you such quick updates, which is why myFICO is our go-to credit score monitoring tool.

4. Identity Theft Insurance and Monitoring

Identity theft is the most common issue in the United States, and this can directly affect your credit situation. With myFICO, you can monitor if your identity is safe and not compromised while you also get identity theft insurance included with your plan.

However, one of the downsides that most users look over is which company is providing this theft insurance. Is it myFICO itself or a third-party company? Here, myFICO does not take care of your identity theft insurance, and it only helps you avail of it. Rather, the American Bankers Insurance Company in Florida is behind in covering your identity theft insurance, and they have their own terms and policies that you might be keen to look into.

Identity theft insurance is available on all myFICO plans, and it is covered by your membership. So, it is important that you fill out your details correctly and know that you must keep your membership active to later redeem your identity insurance when it is time.

What Credit Data is Monitored using myFICO – Equifax, Experian, and TransUnion

Unlike other Credit Score tools and platforms, myFICO does not track all your credit data and transactions. Here, myFICO only monitors selective transactions on your credit reports, and this situation is the same for all three credit bureaus.

Here is what credit data is monitored using myFICO,

| Experian | Equifax | TransUnion |

|---|---|---|

| Newly opened credit account | Newly opened credit account | Newly opened credit account |

| Inquiries from applications for new credit | Inquiries from applications for new credit | Inquiries from applications for new credit |

| New addresses | New addresses | New addresses |

| Newly listed collection accounts | Newly listed collection accounts | Newly listed collection accounts |

| Balance change ($1 or greater) | Balance change ($1 or greater) | Balance change ($1 or greater of account type) |

| Newly listed public record (bankruptcy) | Newly listed public record (bankruptcy) | Newly listed public record (bankruptcy) |

| Change to public record and collection account | Change to public record and collection account | Change in credit account status (aggregated by account type) |

| Change in credit limits ($100 or greater) | Change in credit account status | Change in credit limits (aggregated by account type) |

| Change in credit account status | Change to the name listed on your credit report | Change to public record and collection account |

| Fraud alert placed on file | – | Fraud alert placed on file |

| High revolving account utilization (greater than 75%) | – | New employment listed on your credit report |

How are myFICO Scores Calculated?

You must be wondering how your FICO Scores are calculated and what the factors that affect your score are and what their impacts are. myFICO uses five major factors to calculate your credit score – payment history, amounts owed, length of credit history, credit mix, and new credit.

Let’s closely look at each of these factors and how they are used to calculate your credit scores.

1. Payment History (35%)

Payment History accounts for 35% of your FICO scores and is a major factor that users need to take care of. With this factor, creditors can know if you have made timely payments in the past, and it helps them assess the risk. Your credit report helps myFICO know when you have made the payments, and then you can use this information to calculate your score.

So, if you have made timely and quick payments in the past, you can expect higher FICO Scores and have better chances of getting loans.

2. Amounts Owed (30%)

The second biggest factor that impacts your FICO Scores is the amounts owned. Meaning if you are using most of your available credit, banks may endanger it as overuse and mostly default on your total credit.

The amount owned factor is not only about the available credit but also its over-usage. Rather, there are multiple factors, such as amounts owned in different types of accounts (for example, credit loan vs. installment loan), accounts with balances, credit utilization ratio, and installment loans that are still to be repaid.

3. Length of Credit History (15%)

Having a long credit history does not help you get a good credit score, but it surely influences your FICO scores. There are a couple of factors, such as the length of credit history, that directly or indirectly help you get a good FICO score.

Here are some of the factors,

- The age of your oldest account, newest account, and the average age of all your accounts to establish how old your credit history

- How long since your credit accounts have been open

- For how long your credit accounts have been used

The length of credit history helps myFICO understand how you have been managing your credits. If your credit repayment and usage patterns are uneven or untimely, there is a good chance that you will have lower FICO Scores. Your credit history is quite important for your current and future loans, so timely repayment is one of the good habits for better credit in the future.

4. Credit Mix (10%)

The fourth factor that FICO considers when calculating your FICO Score is credit mix. This factor accounts for 10% of your total FICO Score and is one of the important factors.

But what is Credit Mix? Credit Mix is the mixture of all your other revolving and installment accounts. Your credit cards, retail store cards, gas station cards, and HELOC are considered under revolving accounts. FICO monitors such accounts and looks at your credit usage to determine your financial condition. On the other hand, installment accounts such as mortgage, auto, and student loans also contribute to your credit mix factor.

Besides, to check all these accounts, a hard inquiry is placed on your account, and it will stay for at least two years on your credit report. In addition, if you have opened several accounts in a shorter period, creditors can look at it as financial distress and may reduce your score and chances to avail of loans.

5. New Credit (10%)

If you are taking new credit even after having a lot of debts, excluding the credit builder loan, it is likely that creditors will consider your financial situation under distress. This is especially true when you don’t have a long credit history and are still taking newer loans.

Alongside this, it is also important not to have many inquiries on your credit report. When you apply for credit, creditors place an inquiry on your report to know your historical credit, payment history, and more. Having more inquiries on your credit report only means that you have applied for several credits and are in financial trouble. Creditors look at this as a risk that you are likely to repay back, and if you do, it will likely not be on time.

So, if you have many credit requests and inquiries, this factor will be low, but if your current credit buffer is empty or there are fewer requests, you will have better Credit Mix scores. With myFICO, you can track these and look at them from the creditor’s perspective to know if you will get new credit.

How to Improve FICO Scores

FICO scores are calculated based on several factors and are not entirely dependent on paying bills on time. There are a few common factors that one needs to pay attention to to get their FICO credit score improved; they are:

- Timely payments: In the FICO score, timely payments are accountable up to 35%, and when done timely, you’ll have a chance to get a better credit score. On the other hand, if you have non-timely payments in your books, it will equally show damage to your FICO score.

- Credit used: The percentage of credit used is accountable for up to 30% of your FICO score. If the credit used percentage is less, you will likely have a better FICO score, indicating that many funds are unused and easy to pay.

- Credit age: The average duration of time someone has been using is considered credit age and accounts for up to 15% of the FICO score. In simple terms, The older, the better.

- Type of credit: This is an important factor and holds up to 10% of FICO scores. Certain credits are not good for your FICO score, while a few types of credits do no harm.

- Credit inquiries: If a lot of organizations or individuals are pulling your credit history, it leaves a negative mark on your FICO scores.

Start Your Credit Repair Business

Credit Repair Cloud is the best alternative to DisputeBee for starting a credit repair business or improving your credit scores. It is an industry-dominant and growing company that helps entrepreneurs start their credit repair businesses. It offers software, systems, and strategies to start your own credit repair business.

How Much Does myFICO Cost?

If you are looking forward to getting your credit score and report monitored using myFICO, you might want to know all your plans and options. Also, with multiple plans, which is the one that suits your needs and purpose? Let’s look at a closer breakdown.

Pricing

90% of top lenders use FICO® Scores—do you know yours? Choose your plan.

Basic

$19.95/mo

1-bureau (Experian) coverage

Updates are available every month

Advanced

$29.95/mo

Complete 3-bureau coverage

Updates are available every month

Premier

$39.95/mo

Complete 3-bureau coverage

Updates are available every month

The basic plan is the barest monitoring you can do to monitor your credit scores and reports. Using this plan, you can only cover a single credit bureau (Experian) and get monthly updates. Besides, it does not cover identity monitoring, which might not be a good option if you only look for an identity monitoring tool. In my opinion, the basic plan does not work for most users, and they should look for an advanced or premier plan.

The Advanced and Premier plan does the most credit and identity monitoring while covering all three bureaus. However, the advanced plan gives you an update once every three months, while the premier plan updates you every month. If you want to start a credit repair business, the premier plan should help you with quick changes in your scores and reports.

How do I sign up for my FICO account and membership?

Creating an account on myFICO and subscribing to one of its plans is nothing trickier. Unlike DisputeBee, you also don’t need to have your IdentityIQ Credentials to complete the account creation and go ahead with checking your FICO scores

To sign up for myFICO account,

- Navigate to the myFICO website on your browser; doing it on a desktop or a laptop with a faster internet connection will be the best.

- Now, scroll down and choose one of the myFICO plans that suit your needs, and click on the “Start Plan” button.

- You now need to enter a valid and accessible email address, choose a password, and then click on the “Continue” button to create an account.

- Enter your personal information details such as name, date of birth, street address, zip code, city, phone number, and more.

- Once done, click on the “Continue” button, and on the new screen, you can find the payment options that you can use to subscribe to the plans.

- Now, review your plan and payment information and then proceed with the payment.

- The final step is to verify your identity, and after the verification is done, you can easily check the FICO Score using your account or the app.

How to Cancel myFICO Membership

If you are unhappy with your myFICO service or have found another alternative that suits your needs, you can easily cancel your myFICO membership.

To cancel your myFICO membership, you can navigate to the subscriptions page on your device using the Android or iOS app. Under the “More tab,” you can find an option to cancel your membership. Your subscription will now be canceled. However, this is not the only way to cancel your myFICO membership.

You can also cancel your myFICO membership by calling 1-800-319-4433 (Monday – Friday, 6:00 AM to 6:00 PM PT or Saturday, 7:00 AM to 4:00 PM PT).

Note: If you do not cancel your membership before the renewal period, your membership will be automatically renewed depending on your initial subscription plan and price.

Support and Help on myFICO

While myFICO is a costly service, and you are paying a lot to only monitor your credit scores and identity theft, support and help sections turn out to be one of the crucial things you get. Support and help sections are great when you have issues with your account, tool, or service. Likely, most times, certain features are hard to use, and in this case, the support and help sections help you understand how to use the tool.

Thankfully, myFICO has a good support and help section to help you with using the tool and other questions. There are topic-specific help articles on accounts, credit score monitoring, payment and billing, identity monitoring, accounts, and more. Besides, you can always get in touch with them using their support call number or email or even visit their office when you are in distress.

If you have certain doubts that you would like to discuss with like-minded myFICO users, you can make the discussion with the active community and expect a great and fair response. There is also a credit education and blog page to help you with improving your FICO Scores.

In my opinion, the support and help section with myFICO is a great showcase for the website and help. However, most users complain of unresponsive calls and emails, which is a big downside for a credit score monitoring company with such high plans and prices.

Is myFICO Worth it?

You must be wondering if myFICO is worth the price and if you should have it to monitor your credit scores. With myFICO, you definitely get two major features: credit score monitoring and identity theft insurance.

With all the active credit monitoring, myFICO is best if you need to continuously track your credit data and scores. This is especially true when you are working to improve your credit scores or repairing your credit situation, which requires tracking of repairs and changes. In such a case, identity theft monitoring and insurance is something added and not required, costing you only more on your subscription, and you should be looking for an alternative instead.

If you have constant credit monitoring, have your identity at risk, or need updates on your credit reports and FICO Scores, myFICO is one of the considerable and best options.

Our Verdict: myFICO Credit Score Monitoring Review

In conclusion, myFICO is a considerable tool that works for most users but doesn’t work for a few. Getting quick updates on changes in your credit scores and updates is helpful when you are working on improving the FICO Scores or trying to get new credits. The tool gives you two major features – credit monitoring and identity theft insurance. The credit score monitoring feature is impeccable and helpful, but the identity theft insurance is not really a good pair and option with it; it doesn’t work better than most of the other identity theft insurance tools.

With multiple FICO Scores, myFICO helps you know your credit situation in most cases – auto loans, mortgages, and more. Overall, the tool is handy, and you can try it to check if it really works to meet your requirements. However, if you plan to cancel the membership, do cancel before the automatic renewal, as it is rare to get a refund from myFICO in such a situation.

Frequently Asked Questions

It is a three-digit score ranging from 300 to 850 points credit score model, and the higher the points, the easier it is to get loans or credit.

Credit Score and Vantage Score are the two best alternatives to FICO Scores that can be obtained using various platforms and tools like Credit Karma.

Credit Karma is the best alternative to myFICO and helps you get a free Vantage Score, which differs from the FICO Scores credit model.

Five factors are used to calculate the FICO Scores: 1. Payment history, 2. Amounts owed, 3. Length of credit history, 4. Credit Mix, and 5. New credit.

There are a couple of ways that you can use to improve your FICO Scores – 1. Timely payments, 2. Credit use, 3. Credit age, 4. Type of credit, and 5. Credit inquiries.

More than 30+ FICO credit scores are based on their purposes; FICO 8 and FICO 9 are used for credit lending, and FICO 10 for credit risk. Each time, you can have a different FICO score, as it widely depends on the FICO scoring model used.

There are credit scoring models lenders prefer to use based on their preferences. However, FICO and Vantage credit scores are two of the most popular credit scoring models lenders use.

FICO is a type of credit score, and they are basically the same. However, the difference is streamlined and diversified credit rating as per FICO’s purpose.

Frequently Bought Together

Monitoring your FICO Score alone is not enough; you must also improve them and fix your credit report using credit repair tools. Additionally, you can also start a SaaS-based credit repair business with tools like Credit Repair Cloud.

Credit Repair Crash Course

DisputeBee Credit Repair Tool

Credit Repair Cloud | Credit Repair Business

What Other Customers Say About myFICO

There are a few bad user experiences, and it has been a concern for most new users when it comes to using myFICO. However, there are also a few verified positive reviews about the tool that help the community understand the tool works right on the spot for them. In my opinion, the tool works, but not all the time, and there are major complaints that the tool needs to be taken care of.

Here are some reviews by other customers,

Do you have your own experience to share with this tool? Send it to us right away, and we will publish it.

Also read: 10 Tips to Avoid Credit Card Skimming Fraud: Let’s Play it Smartly

The Credit Saint

Ranked #1 in tackling inaccurate credit entries, Credit Saint is appreciated by almost every other consumer company. It has better plans and a simple process. The best part? You get a 90-day money-back guarantee.

There are pricing models designed as per the need of consumers and well suit their interests. This credit repair company also back #1 position in BBB credit rating and consumer affairs.

| In Business Since | Overall Rating | Reputation Score |

|---|---|---|

| 2004 | 4.7/5 | 9/10 |

The Credit People

Credit People has helped thousands of people fix their credit reports. By far, it is one of the cheapest and least expensive services, with better results and dedicated professionals.

The perks of using The Credit People include free credit scores and credit reports when you opt for their services. These affordable credit restoration services can boost your credit score with an average of 53-187 credit points.

| In Business Since | Overall Score | Reputation |

|---|---|---|

| 1999 | 4.5/5 | 9.0/10 |

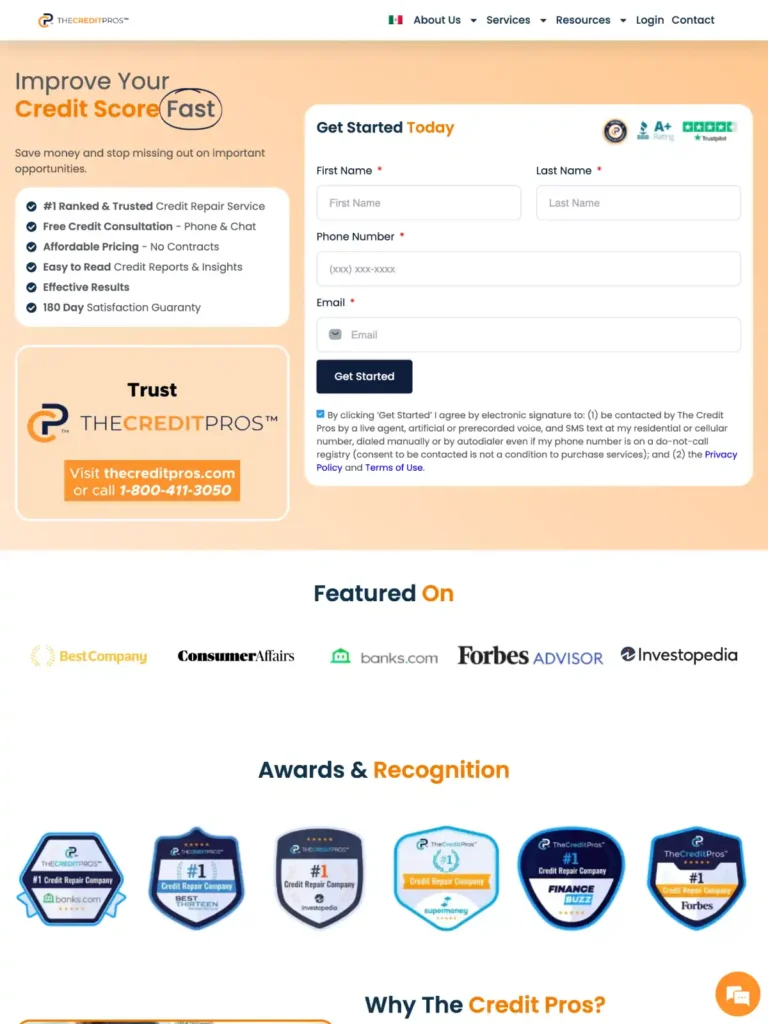

The Credit Pros

TheCreditPros.com offers a comprehensive range of credit repair services designed to help improve your credit score quickly and efficiently. They provide personalized dispute letters, credit monitoring, and identity theft protection.

With a team of experienced professionals, TheCreditPros.com ensures compliance with legal standards, and its user-friendly platform makes it easy to track your progress. Their customer-centric approach and transparent pricing have earned them high ratings and positive reviews from satisfied clients.

| In Business Since | Overall Score | Reputation Score |

|---|---|---|

| 2009 | 4.7 | 8/10 |

Credit Firm

Serving in key financial areas ever since 1997, The Credit Firm has proven to be one of the best. With the support of professional attorneys, credit repair experts, financial guides, and dozens of other core members on the team, it has proven to be actionable in and around 50 states of America.

“Credit Firm” has a straightforward process for fixing credit scores, making them one of the best. This service is best for those who are looking for better jobs and faster credit and loan approvals.

| In Business Since | Overall Rating | Reputation Score |

|---|---|---|

| 2010 | 4.0 | 7/10 |